The 5 Best Apps for Saving Money in 2025

Saving money isn’t as simple as just “buckling down.” With rising expenses and stagnant wages, setting aside cash can feel like an uphill battle. In fact, only 15% of Americans can easily come up with $2,000 in an emergency, according to a Federal Reserve survey analysis by The Penny Hoarder.

But here’s the good news: technology is on your side. With the right money-saving apps, you can automate your savings, cut unnecessary expenses, and even invest effortlessly. Let’s dive into the best apps to help you grow your savings in 2025.

Top 5 Money-Saving Apps for 2025

With so many personal finance apps available, finding the right one can be overwhelming. We’ve rounded up five of the best options to make saving money easier than ever.

1. Cleo: Your AI-Powered Financial Sidekick

Cleo is an AI-driven money assistant with a sassy personality, helping users take control of their finances in an engaging way. This chatbot can analyze your spending habits, create personalized budgets, and even fine you for overspending.

Why You’ll Love It:

- Automatically rounds up purchases and saves the spare change

- Provides financial insights and budgeting tips

- Offers up to $250 in spot cash (eligibility requirements apply)

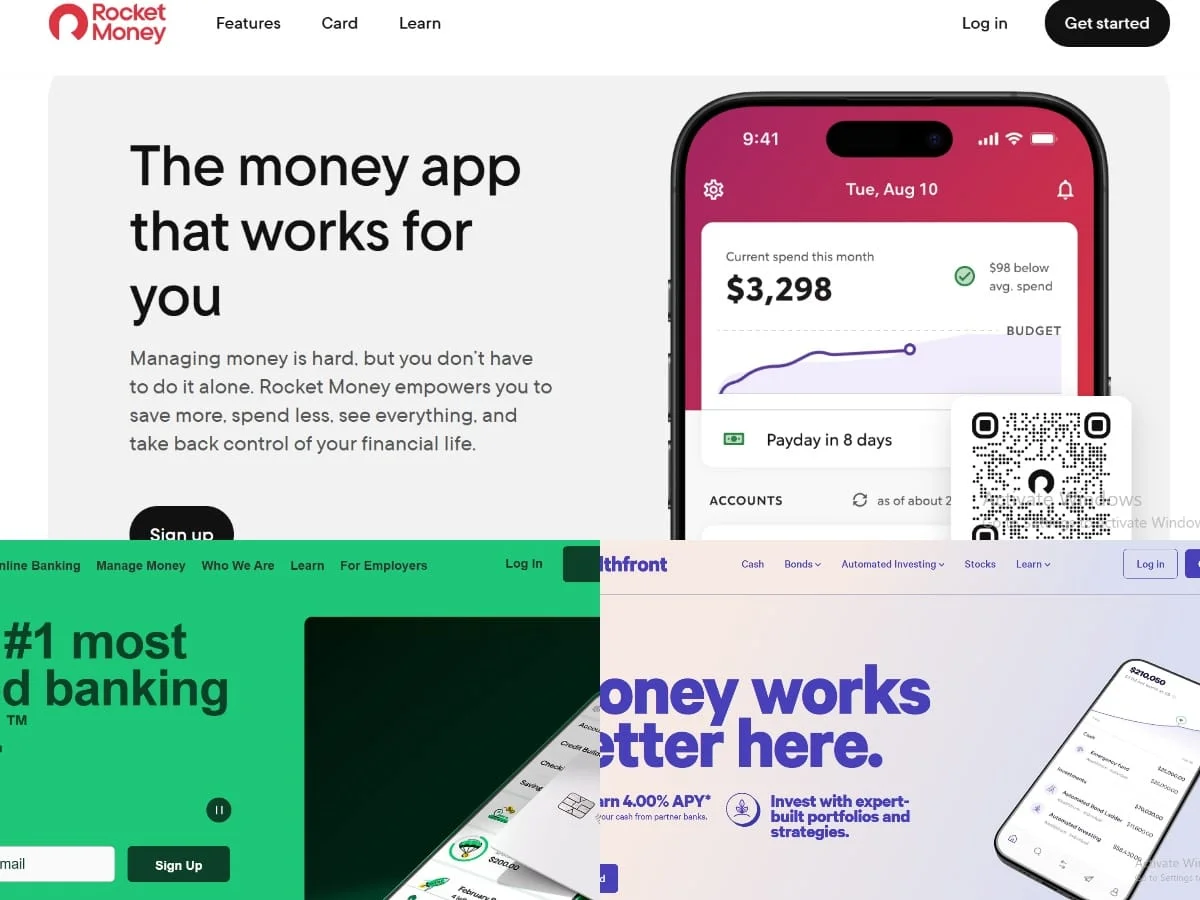

2. Rocket Money: Find and Eliminate Wasted Expenses

Have you ever checked your bank statement and found random charges for unused subscriptions? Rocket Money helps you track down and cancel unwanted subscriptions while negotiating lower rates on your bills.

Why You’ll Love It:

- Saves users an average of $720 per year

- Cancels unused subscriptions with one click

- Negotiates lower bills with internet, phone, and other providers

3. Wealthfront: Make Your Savings Work for You

If you want to grow your savings beyond a traditional savings account, Wealthfront is an excellent option. This automated investment platform helps you build a diversified portfolio tailored to your financial goals.

Why You’ll Love It:

- Low advisory fee of just 0.25% per year

- No trading fees, making investing more cost-effective

- Features Tax-Loss Harvesting to minimize your tax bill

- New users get a $50 bonus when they deposit $500 (terms apply)

4. Public: A Smarter Way to Save with Treasury Bills

For a safer way to grow your savings, Public offers Treasury accounts that let you invest in U.S. Treasury bills. These investments are backed by the government and often come with better yields than traditional savings accounts.

Why You’ll Love It:

- No state or local taxes on Treasury bill earnings

- Start investing with as little as $100

- Treasury bills automatically reinvest for compounding growth

5. Chime: The All-in-One Savings Solution

Chime simplifies saving by automatically rounding up your purchases and transferring the spare change into your Savings Account. Plus, you can set up automatic savings transfers and avoid overdraft fees.

Why You’ll Love It:

- No monthly fees, overdraft fees, or minimum balance requirements

- Automatically saves spare change from every purchase

- Connects Checking and Savings Accounts for seamless money management

Need More Help? Try a Budgeting App

If saving still feels overwhelming, a budgeting app might be the missing piece. These apps help you track expenses, create realistic budgets, and identify areas where you can cut back.

FAQ: Common Questions About Money-Saving Apps

Are money-saving apps safe?

Yes, reputable apps like Cleo and Rocket Money use advanced security measures to protect your data.

Are automated savings apps worth it?

If you struggle to save consistently, these apps can be a game-changer by making the process effortless.

How do I choose the best money-saving app?

Consider security, fees, ease of use, and savings strategies to find an app that fits your lifestyle.

Can these apps help me grow my savings?

Absolutely! Many apps automate savings, while others invest your money to maximize returns.

How do I start using a money-saving app?

- Choose an app based on your financial goals.

- Download and set up your account.

- Link your bank account and configure savings settings.

- Monitor your progress and adjust as needed.

By leveraging the power of these money-saving apps, you can take control of your financial future and build wealth effortlessly in 2025.

Loading comments...

Leave a Comment(Login required)