Understanding Credit Scores: What Impacts Your Score and How to Improve It

Introduction

Your credit score is one of the most crucial numbers in your financial life, yet many Americans struggle to understand how it works. According to the Federal Reserve’s 2022 Survey of Consumer Finances, nearly 28% of adults have credit scores below 650, which significantly limits their access to favorable loan terms and can cost them thousands of dollars over their lifetime. More From Mobelwealth: How to Pay off Credit Card Debt in 2025

After working with hundreds of clients over the past decade, I’ve seen firsthand how credit score misconceptions can derail financial goals. The good news? Credit scores aren’t mysterious black boxes – they follow predictable patterns that you can learn to work with rather than against.

What Is a Credit Score and Why Does It Matter?

A credit score is a three-digit number ranging from 300 to 850 that represents your creditworthiness to lenders. Think of it as your financial report card that follows you everywhere you go. The most commonly used scoring model is the FICO Score, developed by the Fair Isaac Corporation, though VantageScore has gained popularity in recent years.

The financial impact of your credit score extends far beyond just loan approvals. Data from myFICO shows that someone with a credit score of 620 might pay $65,000 more in interest over the life of a 30-year, $300,000 mortgage compared to someone with a score of 760 or higher. That’s enough money to buy a luxury car or fund a comfortable retirement. More From Mobelwealth: The 7 Best Travel Credit Cards of 2025

The Five Factors That Determine Your Credit Score

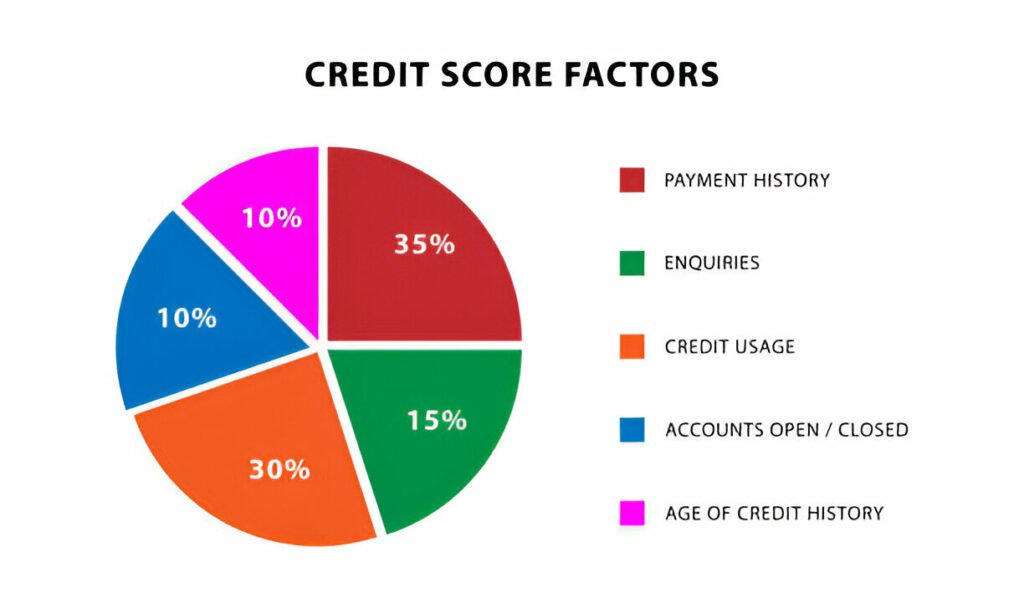

Understanding what impacts your credit score is the first step toward improvement. FICO breaks down scoring into five distinct categories, each carrying different weight in the calculation.

Payment History (35% of Your Score)

Payment history carries the most weight in your credit score calculation, and for good reason. Lenders want to know if you’ll pay them back on time. According to Experian’s 2023 Consumer Credit Review, the average American has 3.84 credit accounts, making consistent payment management crucial.

Even one missed payment can significantly impact your score. A 30-day late payment can drop your score by 60 to 110 points, depending on your current score and credit history. The higher your score, the more dramatic the drop tends to be.

What many people don’t realize is that payment history includes more than just credit cards and loans. Utility bills, medical debt, and collection accounts all factor into this category. I’ve seen clients surprised to discover that an old medical bill they forgot about had been sent to collections, dragging down their score for years.

Credit Utilization (30% of Your Score)

Credit utilization – the percentage of available credit you’re using – is the second most important factor. The Consumer Financial Protection Bureau recommends keeping your utilization below 30%, but the sweet spot for optimal scores is actually much lower.

Based on analysis of millions of credit profiles, consumers with the highest credit scores typically maintain utilization rates below 7%. This might seem restrictive, but it’s one of the fastest ways to improve your score. Unlike payment history, which takes time to build, you can lower your utilization immediately by paying down balances or increasing credit limits.

Both overall utilization and per-card utilization matter. Having one card maxed out can hurt your score even if your overall utilization is low. This is why having multiple cards with low balances often produces better scores than having one card with a moderate balance.

Length of Credit History (15% of Your Score)

Time is your friend when it comes to credit scoring. This factor considers both the age of your oldest account and the average age of all your accounts. Data from Credit Karma shows that consumers with excellent credit scores have an average account age of over 11 years.

This is why financial experts often recommend keeping old credit cards open, even if you’re not using them actively. Closing your oldest card can immediately reduce your average account age and potentially lower your score. However, this advice comes with caveats – if an old card has an annual fee and you’re not getting value from it, the cost might outweigh the credit benefit. More From Mobelwealth: 5 Strategies to Consolidate Your Credit Card Debt

The length of credit history also explains why young adults often struggle with credit scores despite having perfect payment records. Time simply cannot be rushed, which is why starting to build credit early is so valuable.

Credit Mix (10% of Your Score)

Having different types of credit accounts – credit cards, auto loans, mortgages, personal loans – can positively impact your score. This factor demonstrates to lenders that you can manage various types of credit responsibly.

According to FICO’s research, people with the highest credit scores typically have a mix of both revolving credit (credit cards) and installment loans (mortgages, auto loans). However, this doesn’t mean you should take on debt just to improve your mix – the potential score boost isn’t worth paying unnecessary interest.

New Credit (10% of Your Score)

This factor looks at recent credit inquiries and newly opened accounts. Each hard inquiry can temporarily lower your score by a few points, and multiple inquiries in a short period can compound the effect.

However, the credit scoring models are smarter than many people realize. When you’re shopping for a mortgage or auto loan, multiple inquiries within a 14-45 day window are treated as a single inquiry. This allows you to shop for the best rates without destroying your credit score.

Common Credit Score Myths Debunked

The internet is full of credit score misinformation that can actually hurt your financial health. Let me address some of the most persistent myths I encounter.

Myth: Checking your credit score hurts it. This is completely false. When you check your own credit score, it’s considered a “soft inquiry” and has no impact on your score. You should be checking your score regularly – I recommend monthly.

Myth: You only have one credit score. You actually have multiple credit scores because there are different scoring models (FICO, VantageScore) and each can vary slightly depending on which credit bureau’s data is used.

Myth: Closing credit cards always improves your score. This can actually hurt your score by reducing your available credit (increasing utilization) and potentially lowering your average account age.

Myth: You need to carry a balance to build credit. This costly myth leads people to pay unnecessary interest. Your credit utilization is reported regardless of whether you carry a balance month to month.

Step-by-Step Guide to Improving Your Credit Score

Improving your credit score isn’t about quick fixes – it’s about developing sustainable habits that compound over time. Here’s a practical roadmap I’ve developed based on what actually works.

Immediate Actions (0-30 Days)

Start by obtaining your free credit reports from all three bureaus at AnnualCreditReport.com, the only government-authorized source. Review each report carefully for errors, which the Federal Trade Commission estimates appear on 20% of credit reports.

Pay down credit card balances to reduce utilization. If you can’t pay them off entirely, aim to get each card below 30% utilization, with a goal of under 10% for optimal scoring.

Set up automatic payments for at least the minimum amount on all accounts. Late payments are score killers, and automation removes the human error factor.

Short-Term Strategies (1-6 Months)

Consider requesting credit limit increases on existing cards. Many issuers allow online requests, and if approved, this immediately improves your utilization ratio. However, only do this if you trust yourself not to increase spending.

If you have limited credit history, consider becoming an authorized user on a family member’s account with good payment history. The Consumer Financial Protection Bureau notes this can help build credit, but ensure the primary cardholder has excellent habits.

Address any collections accounts strategically. Sometimes paying collections can actually lower your score initially, so research “pay for delete” agreements or consult with a credit counselor before taking action.

Long-Term Credit Building (6+ Months)

Focus on maintaining the habits that build credit over time. Consistent, on-time payments and low utilization are the foundation of excellent credit. More From Mobelwealth: 7 Ways You Can Get a Home Loan With Bad Credit

Consider diversifying your credit mix gradually and organically. If you’re in the market for a car or home, the installment loan can help your credit mix, but don’t take on debt solely for credit purposes.

Monitor your credit regularly using free tools like Credit Karma or your bank’s credit monitoring service. Many credit cards now offer free FICO scores to cardholders.

Advanced Credit Optimization Strategies

For those serious about maximizing their credit scores, there are advanced techniques that can provide additional benefits.

Timing your payments strategically can help optimize your utilization reporting. Most credit cards report your balance to credit bureaus on your statement closing date, not your payment due date. By paying down balances before this date, you can show lower utilization even if you pay the full balance by the due date.

The all-zero-except-one (AZEO) method involves paying all cards to zero except one, which you keep at a low balance (ideally under $10). This technique can boost scores by 10-20 points for some people, though it requires careful timing and organization.

Credit card churning for sign-up bonuses can be done while maintaining good credit, but it requires discipline and understanding of how inquiries and new accounts affect your score.

When to Seek Professional Help

While most people can improve their credit scores on their own, certain situations warrant professional assistance. If you’re dealing with identity theft, complex bankruptcy recovery, or have numerous collection accounts, a legitimate credit counselor or attorney might be worth the investment.

Be extremely wary of credit repair companies that promise to remove accurate negative information or guarantee specific score increases. According to the Federal Trade Commission, these companies often use tactics you could do yourself for free.

The Psychology of Credit Score Improvement

Improving your credit score is as much about psychology as it is about tactics. The behaviors that build excellent credit – consistency, patience, living below your means – are the same behaviors that build wealth over time.

Many people get discouraged because credit score improvement isn’t linear. You might see quick gains initially, then hit plateaus where progress seems slow. This is normal and expected. The key is maintaining good habits even when progress isn’t immediately visible.

Technology Tools for Credit Management

Modern technology has made credit management easier than ever. Apps like Mint, Credit Karma, and bank-specific tools can send alerts when balances get too high or payments are due. Some apps even analyze your spending patterns and suggest optimizations for better credit utilization.

Automatic payments are particularly powerful. Set up autopay for at least the minimum payment on all accounts, then manually pay additional amounts as needed. This ensures you never miss a payment due to forgetfulness or busy schedules.

The Long-Term Financial Impact

Excellent credit scores compound their benefits over time. Beyond lower interest rates on loans, good credit can mean lower insurance premiums, better apartment rental terms, and even job opportunities in some fields.

Consider this: if improving your credit score saves you 1% on a $300,000 mortgage, that’s $3,000 per year or $90,000 over the life of the loan. These savings can fund retirement accounts, emergency funds, or other wealth-building activities.

Conclusion

Your credit score is a powerful financial tool that deserves careful attention and strategic management. While the system might seem complex, the fundamentals are straightforward: pay on time, keep balances low, maintain old accounts, and be patient with the process.

The strategies outlined here aren’t just theoretical – they’re battle-tested approaches that have helped thousands of people improve their financial standing. Remember, credit score improvement is a marathon, not a sprint. Focus on building sustainable habits rather than chasing quick fixes, and your future self will thank you for the discipline you show today.

The most important step is simply starting. Check your credit report today, identify areas for improvement, and begin implementing these strategies. Your credit score – and your financial future – will benefit from the attention you give it now.

Frequently Asked Questions

Q: How long does it take to see improvements in my credit score? A: You can see improvements in as little as 30 days for changes like reducing credit utilization. However, significant improvements typically take 3-6 months of consistent good habits, while building excellent credit can take several years.

Q: Will paying off collections accounts improve my credit score? A: It depends on your situation and the scoring model used. Older scoring models may not improve immediately after paying collections, while newer models give less weight to paid collections. Consider negotiating a “pay for delete” agreement before paying.

Q: How many credit cards should I have for the best credit score? A: There’s no magic number, but having 2-4 credit cards with low balances typically produces better scores than having just one card. The key is managing them responsibly and keeping utilization low across all cards.

Q: Does income affect my credit score? A: No, your income is not directly factored into credit score calculations. However, higher income can make it easier to manage credit responsibly, which indirectly benefits your score through better payment history and lower utilization.

Q: Should I close old credit cards I don’t use? A: Generally, no. Keeping old cards open helps your credit age and available credit, both of which benefit your score. Only close cards if they have annual fees you can’t justify or if you’re concerned about overspending.

Q: Can I improve my credit score if I have no credit history? A: Yes, but it requires starting somewhere. Consider becoming an authorized user on a family member’s account, applying for a secured credit card, or using credit-builder loans. Building credit from scratch typically takes 6-12 months to establish a score.

Q: How often should I check my credit score? A: Monthly monitoring is ideal and won’t hurt your score. Many banks and credit cards now offer free score monitoring. Additionally, check your full credit reports from all three bureaus at least annually through AnnualCreditReport.com.

Q: What’s the difference between FICO and Vantage Score? A: FICO is used by about 90% of lenders and has been around longer, while Vantage Score is newer and used by some lenders and many free credit monitoring services. Both use similar factors but weight them differently, which can result in different scores for the same person.

Loading comments...

Leave a Comment(Login required)